Welcome to the new and improved Story Surveillance, your weekly intel briefing on the business of Hollywood and intriguing intellectual properties (IP) ripe for adaptation. We want to make SS more useful for us, but also for you. Please take a moment to let us know what's useful, what's not working, what you'd like more of and we'll make sure to do our best in future editions. As usual we’ve scoured the latest books, long-form journalism, podcasts, backlist gems, and international hits to uncover high-concept stories with cinematic potential, but we also added new sections about commissioning mandates and cultural vibes. Happy hunting!

👋

If someone forwarded this to you, welcome to the newsletter. Please get in touch: storysurveillance@projectbrazen.com if you'd like to learn more. If you want to talk about Brazen's slate of projects, feel free to book a time with Bradley.

Contents (Issue #53)

- 🔮 Buying Trends (Powered by Mandate Wizard)

- Apple’s “Premium Populist” pivot and what streamers are really greenlighting now

- 💅 The Vibe

- Zendaya’s viral horror arc, Gen Z’s spiritual turn, and the breakup economy boom.

- 📚 Books (New & Upcoming Fiction)

- A tutor on the run and a Thelma & Louise-style thriller with murder and memes.

- 🎧 Podcasts (Narrative Audio)

- The Yale clinic scandal where women screamed — and no one believed them.

- 🗂️ Backlist & Forgotten Gems (Older IP worth revisiting)

- Unsolved art thefts and the cyberpunk classic Hollywood still hasn’t cracked.

- 🌍 International IP (Foreign Language & Global Hits)

- A nostalgia-fueled clinic that spirals into national time-travel fever dreams.

🔮 Trends

Apple TV+: Prestige with Popcorn Edges

Sources: Recent meeting between Apple teams and development executives, plus THR, Deadline.

- Premium Populist is the new mantra — sophisticated, commercial, hooky storytelling.

- Crime, genre, thriller remain strong lanes (Black Bird, Hijack, Sugar, Criminal Record, Presumed Innocent).

→ “Apple’s most consistent viewership winners have emerged in high-end thriller and crime formats.” - More open to IP, especially legacy or stylized takes.

→ Monarch: Legacy of Monsters cited in Deadline as Apple’s most globally successful IP-based original. Apple renewed and expanded the deal with Legendary in April 2025. - Pop-culture drama lane broadening — projects in the Daisy Jones and celebrity satire vein gaining internal favor.

- Biopic fatigue is real — shift away from overly faithful retellings.

- Looking for white-space outside of crime/genre — period drama, pop zeitgeist themes. “What’s our non-crime, non-genre way into a series?”

- Anthology series = cold unless there’s continuity (Presumed Innocent model).

- Script-first encouraged, pre-pack not essential.

→ “We love to read scripts — helps us break past narrowing notes.” - Increasingly open to producing in-house. "We're feeling more confident to do things based on IP ourselves."

🎯 Other Streamer Trends (Spring 2025)

🔴 Netflix: Engagement Over Everything

- Engagement > subs — focus is on hours watched, not just sign-ups.

→ Variety, April 2025: Greg Peters calls engagement “the best proxy for subscriber satisfaction.” - Smart curation in full swing — quick cancellations if metrics fall short.

→ Bloomberg, March 2025: Reports that The Brothers Sun and others were axed mid-run due to weak completion. - $18B content spend in 2025 — pushing scale, not slowdown.

→ Netflix Q1 Earnings, April 2025. - Franchise playbook still central — The Witcher, Stranger Things universe expanding.

→ Deadline, April 2025: “Netflix re-ups multiple spin-offs in key universes.”

🟡 Amazon Prime Video: Strategic Reset

- Jennifer Salke exits; Mike Hopkins takes over creative pipeline.

→ Deadline, March 2025: Amazon announces Salke’s departure, internal memo cites need for “clearer creative hierarchy.” - Reevaluation of mega-bets (Citadel, Rings of Power) in light of ROI concerns.

→ Puck, April 2025: “Citadel’s S2 delayed, international spin-offs quietly paused.” - Pivot to franchise-ready IP from MGM (Bond, Stargate, etc.).

→ Variety, May 2025: Amazon Studios strikes new internal Bond roadmap deal without Salke; Stargate reboot in active dev. - Fewer blank-check packages.

→ Insider sources say Mike Hopkins pushing for “accountable hits, not art-for-art’s-sake.” - Increased integration with commerce and games.

→ Amazon Q1 2025 investor call: “Greater synergy across platforms is key to future content ROI.”

⚫ HBO / Max: Prestige Reclaimed

- Name reverting to “HBO Max” — brand value too high to ignore.

→ The Wrap, May 2025: WBD announces summer 2025 rebrand at upfronts. - Mandate reset = fewer shows, higher bar.

→ David Zaslav quote: “The HBO brand is an implicit promise to consumers.” - Event TV prioritized — The Last of Us, The Pitt, White Lotus all cited as cultural drivers.

→ Variety, April 2025: Internal HBO doc points to premium hits as churn-busters. - “Max” reality strategy quietly winding down.

→ Deadline, April 2025: Discovery-style unscripted orders paused unless tied to tentpoles. - Development direction = high-stakes drama, world-class creatives.

→ Interviews with HBO execs emphasize premium pedigree and awards potential.

🔵 Disney+: Back to Core IP & Quality Control

- Bob Iger: “We made too much.” Now it’s quality-over-quantity.

→ Disney Q1 Earnings, February 2025: Iger’s quote during investor Q&A. - Focus on core franchises — Marvel and Star Wars to be treated as “event releases” again.

→ Variety, March 2025: Feige to scale back Disney+ series volume in favor of theatrical quality bar. - Theatrical-first strategy reaffirmed — streaming is downstream of box office again.

→ WSJ, March 2025: Pixar and Disney Animation reaffirm return to theatrical runs before D+ drops. - Streaming finally profitable — content budgets now reflect sustainability.

→ Disney Q1 2025 report: Streaming hits profitability; bundling with Hulu drives retention. - Selective international expansion — local-language content still funded, but IP-driven.

→ Deadline, April 2025: Latin American originals tied to Disney character brands in early development.

This feature is powered by an exciting new technology we developed at Brazen Labs (the technology arm of Brazen), where have spent the last few months building a new tool called Mandate Wizard. Think of it as your most knowledgeable, friendly assistant as you chart out your pitching strategy for a film, TV series of documentary. Mandate Wizard reads everything every day, discovering any "mandate" communicated (Bela Bejaria gives a speech or head of TV at Amazon talks about their shifting strategy) but it also detects inferred mandates (what they don't say out loud but communicate through commissioning, broader interviews, etc.) .

If that's not enough, we also fill it weekly with non-public mandate wisdom from our network of contacts and interactions. Soon, we'll roll out a trial version for our subscribers to try. Get in touch if you're interested: storysurveillance@projectbrazen.com. For now, we'll just share insights here and the Brazen Research team is available for any custom deep dives as well.

💅 The Vibes

This is a new section exploring what's happening in popular culture and what's taking off in social media, which has an impact on commissioning behavior and market receptiveness to projects with a certain tone or point of view.

- Zendaya Hat Theory – A viral TikTok conspiracy-parody implying Zendaya’s penchant for big hats hides some “sinister” secret. This absurd meme (splicing a 2014 photo of Zendaya’s enormous hat with a glitchy interview clip) turned the beloved actress into a tongue-in-cheek horror icon. Gen Z fans ran with the joke, crafting spooky fake lore around Zendaya’s hats.

- Why it matters: It showcases young audiences’ love for participatory, ARG-style storytelling and satire of conspiracy culture – a clue that mysterious, meme-friendly content can spark massive engagement.

- 🦈 “Sharking” All Summer – Forget summer love – Gen Z is declaring this the season of “sharking,” meaning chasing flings with zero intent to commit. Coined by streamer Jay Cinco, “sharking all summer” (now resurging on TikTok) describes an aggressive, emotion-light dating strategy focused on the thrill of the hunt. The meme’s tagline: “the kids are hunting flings, not feelings.”

- Why it matters: Signals a broader youth mood of no-strings-attached fun over romance, which could shape the tone of summer programming – think edgier dating shows or commitment-phobic characters that mirror this playful cynicism.

- Snapchat Situationships – Building on the dating theme, many teens are over today’s undefined online romances. A viral Teen Vogue op-ed by a 17-year-old lamented that in 2025, not using Snapchat is basically “not having a social life” – yet all it yields are situationships, not real relationships. The piece (aptly titled “Is Teen Romance Dead?”) quips that high school love was never as magical as in movies, and maybe we just “really want it to be real.”

- Why it matters: Highlights Gen Z’s growing disillusionment with picture-perfect romance. We may see demand for more authentic, messy love stories on screen (or a sharp uptick in anti-rom-com narratives).

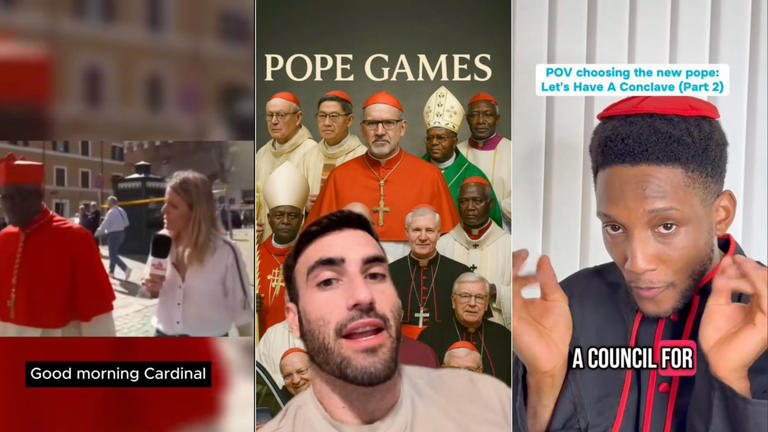

- 🙏 “Conclavecore” (Gen Z Spirituality) – In an unexpected twist, faith is trending. When the Vatican held a papal conclave, nearly 300,000 young people tuned into the chimney livestream and treated it like a pop culture event (yes, there were Pope fantasy leagues and viral Pope memes). Beneath the humor lies a real resurgence in youth spirituality: surveys show the share of very religious young adults is up ~27%, with belief in God among UK 18–24s doubling since 2019.

- Why it matters: A generation known for skepticism is now seeking meaning and community in new ways. Storylines with religious or spiritual themes – handled authentically – might resonate more than Hollywood expects, as Gen Z explores faith alongside irony.

- 🦋 “Ribs” Revival (TikTok Nostalgia) – Lorde’s 2013 deep-cut “Ribs” just hit the Billboard Hot 100 for the first time – 12 years after release – thanks to a viral TikTok trend. Young fans on TikTok co-opted the moody track to soundtrack “Butterfly Effect” videos, dramatizing how tiny coincidences led to big life outcomes (even if most creators got the chaos theory concept hilariously wrong). This ironic nostalgia wave gave a cult favorite song new life, debuting at No. 99 on May 5.

- Why it matters: Gen Z’s nostalgia can propel older IP (songs, shows, characters) back into mainstream relevance overnight. It’s a reminder that a well-placed vintage needle-drop or reboot tease could explode on TikTok, bridging generation gaps in audience and breathing new life into back-catalog content.

- 💔 Breakup Content Economy – Heartbreak is becoming a monetizable content genre. Savvy young influencers are turning their breakups into candid TikTok series – and brands are buying in. Case in point: Gymshark reportedly paid about $33,000 for a fitness influencer’s post-breakup sponsored content in early 2021. From dating-app tie-ins to wellness sponsors, “moving on” journeys are lucrative.

- Why it matters: Audiences (especially Gen Z) crave authentic, vulnerable storytelling – even if it’s raw or messy. This trend suggests opportunities for breakup-driven reality shows, documentaries, or marketing campaigns that approach love and loss with a relatable wink (just beware of veering into exploitation).

- Y2K Nostalgia Mall – Is nostalgia alone enough to entice Gen Z? Vita Coco (yes, the coconut water) teamed up with iconic ‘00s retailer Limited Too for a “Nostalgia Mall” pop-up in NYC. For two days, teens and millennials lined up for free Y2K-style baby tees amid a fake food court and braid bar. The throwback collab got buzz, but some observers eye-roll that “Y2K nostalgia will not save your brand” – especially since Gen Z demands authenticity over pandering.

- Why it matters: The pop-up’s mixed reception is a lesson for content creators: tapping Millennial/Gen Z nostalgia (early 2000s fashion, music, IP) can spark interest, but it needs a fresh twist. Reboots and reunions will succeed only if they feel earned and clever, not like a marketing time capsule. In short, nostalgia is a spice, not the main course.